Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Avalanche at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche network is a smart contract platform designed with the focus on scalability, and achieved through a multichain framework comprising P, X, and C chains. The C-chain on Avalanche Primary Network is the most popular for being EVM-compatible, while also aiming to provide support for apps through its Subnet architecture.

Subnet stands for subnetwork and it represents a set of validators who achieve consensus on the state of the network. A Subnet can be thought of as the bottom layer of the stack and many blockchains can compose on top of a single Subnet. There can be many chains for a single Subnet. To understand more about Subnets in Avalanche, we suggest reading our previous report.

In this quarterly report, we will look into the performance of Avalanche in Q2 2022 as well as the key developments implemented by Avalanche to improve overall network performance and user experience.

Key Development: Q2 2022

Core

- On Jun 22, 2022 Ava Labs released Core, a non-custodial browser extension to securely access Avalanche-based web3 applications, Subnets, bridges, and NFTs.

- Core currently offers nine primary features:

- Bridge

- Token Swap: Swapping directly through the extension

- Token Purchase with fiat (powered by MoonPay): More seamless on-ramp

- Ledger Compatibility

- Portfolio Management

- NFT Gallery

- Subnets

- Address Book

- Managing multiple addresses under the same seed phrase

- Multichain support: all EVM-compatible chains and Bitcoin

- Other features to be added in future releases

New Avalanche Bridge

- At the end of June, Ava Labs launched the new Avalanche Bridge built on Intel SGX technology, replacing the existing Avalanche-Ethereum Bridge (AEB) and promising a faster, cheaper, more user-friendly bridging experience.

- This will also allow users to bridge Bitcoin via Avalanche Bridge from the Bitcoin network.

- Bitcoin bridging would only be available through Core extension and not supported with Metamask or any other wallets. The web UI of Avalanche Bridge does not currently support Core Extension, but full support is coming soon.

New Subnets

As explained in the overview section, Subnets are a major innovation in Avalanche that make users' and developers' experiences more enjoyable. Utilizing and deploying applications on Subnets minimize the amount of gas paid for and the time needed to finalize each transaction as the traffic bottlenecks on the C-chain are eliminated, they are also easy to launch and fully customizable while being entirely EVM-compatible.

New Subnets launched this quarter, including:

- DeFi Kingdoms: Cross-chain, play-to-earn MMORPG built on a strong DeFi protocol. The game features DEX(s), liquidity pool opportunities, and a market of rare, utility-driven NFTs. This Subnet saw around ~160-300k daily transactions in Q2 2022.

- Crabada Swimmer Subnet: Avalanche-native P2E game that has rapidly grown into one of the largest games across Web3. Crabada has seen over $225m in NFT sales and ~110-550k transactions per day in Q2 2022.

Several other Subnets are currently tested and/or in development, including:

- Dexalot: Hybrid financial application that combines traditional centralized exchange experience through a decentralized, on-chain application. It aims to enable users to trade crypto securely and efficiently, with no slippage or custody risk.

- Institutional DeFi: Collaboration among Avalanche, Aave Companies, Golden Tree Asset Management, Wintermute, Jump Crypto, Valkyrie, Securitize, and others to build the first horizontally-integrated blockchain specifically engineered for Institutional DeFi with native KYC functionality.

In the upcoming quarters, we can look forward to the launch of numerous top-tier DeFi and gaming projects as Avalanche Subnets, including Shrapnel, Ascenders, Domi Online, Gunzilla, Castle Crush, and Ragnarok.

Avalanche Ecosystem

Thanks to its fast transactions and low fees, Avalanche boasts a vibrant ecosystem of dApps ranging from DEX(s) like Trader Joe, yield optimizers like Yield Yak, to lending protocols like BenQi. Avalanche also offers rewards in its native token for using its dApps, making it even more enticing for users.

Nansen Data

Daily Transactions

Despite having stable daily transactions from early April, Avalanche saw a significant decrease in transactions on May 12, 2022. That was around the aftermath of the UST de-pegging event and the collapse of LUNA, as well as the start of the redirection of GameFi transactions, such as DeFi Kingdoms and Crabada, from the C-chain to its Subnet. Similarly, the gas paid in this quarter dropped in line with the transaction count.

Daily Active Addresses

The number of daily active addresses showed a similar pattern to the daily transaction count. It looked relatively stable in the beginning of the quarter up to May 4, 2022, where we saw an uptick that peaked on May 6, 2022, up to 110k addresses. The top transactions on those dates came from Crabada, it seemed like the users were preparing for the switch to Crabada’s Swimmer Subnet. From then on, it decreased until it started to stabilize at the end of May towards the end of the quarter.

Daily Transaction Count vs Ethereum

Ethereum maintained a daily transaction count above 900k in this quarter, while Avalanche’s daily transactions lowered significantly after the redirection of GameFi transactions and the effect of the UST de-pegging event. From then on, Avalanche’s transaction count was stable at around 200-300k, except for a peak close to 500k on Jun 13, 2022. Notably, most of the transactions on that date came from Trader Joe, a popular DEX on Avalanche.

Smart Money Segments on Avalanche

The chart above shows a breakdown of the Smart Money Ethereum addresses that are also active on Avalanche. They have been categorized based on the type of Smart Money. Please refer to this link for the specific definitions of each label. From the chart above, First Mover LPs are the highest proportion of Smart Money on Avalanche, followed by Airdrop Pro and First Mover Staking. This changed considerably from the last quarter, where there were higher proportions of NFT-related Smart Money categories. This quarter, the DeFi-related Smart Money categories had the higher percentage.

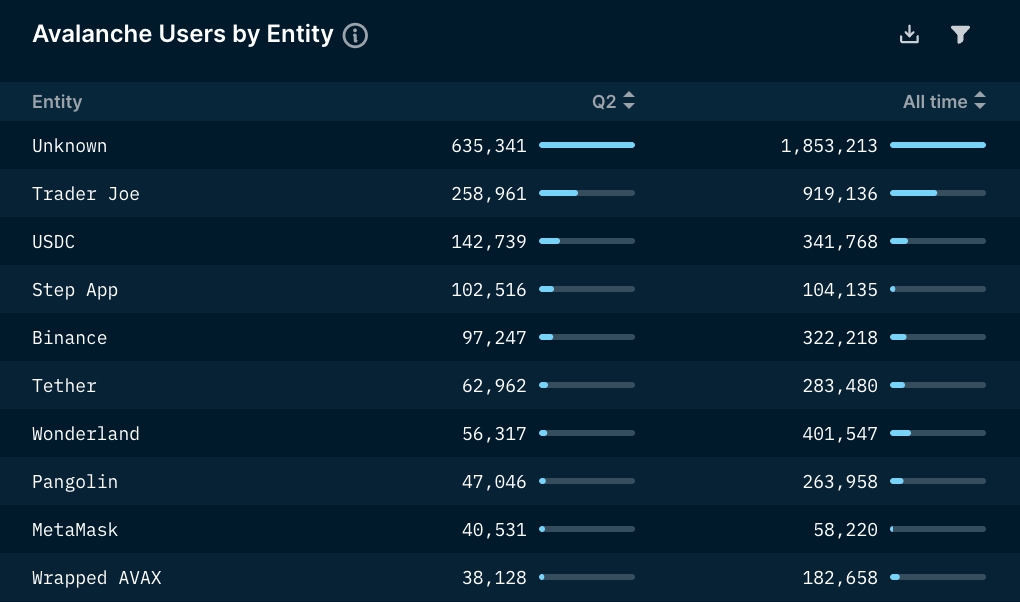

Top Entities and Users

Another important metric to look at is the top entities in Avalanche. From the table above, Trader Joe, a popular DEX on Avalanche, remained the top entity in Avalanche with more than 250k users followed by Step App, which amassed more than 100k users in Q2 2022. Step takes on the move-to-earn meta, allowing users to earn tokens while maintaining their fitness goals. Combining this data with the Smart Money labels above, the volume of Trader Joe could point towards some opportunities within the DeFi space on Avalanche. Lastly, do take note that the “Unknown” entity refers to the sum of all entities that are not yet labeled in Nansen, rather than a single unknown entity.

Avalanche Bridge Stats

The volume bridged into Avalanche via Avalanche Bridge throughout Q2 2022 was rather volatile, as seen from several high peaks above $300m in late April and mid-May. In June, the peaks were merely below $200m. On most days, the amount bridged onto Avalanche was between $20m-75m.

Important note: When checking the Wallet Profiler dashboard of Avalanche Bridge, only transactions from Jul 7, 2022 would be reflected, despite the dashboard mentioning “All Time”. This is attributed to the old Avalanche-Ethereum Bridge contract which became inactive and replaced with the new AB Bridge contract. Nansen users could use the new contract to monitor transactions going forward.

Conclusion

In Q2 2022, Avalanche experienced a decrease in the transactions count after the redirection of Crabada transactions from C-chain to its own Subnet, as well as a possible ripple effect from the UST de-pegging event and LUNA collapse. In spite of that, the chain continued to make improvements, including the release of Core and New Avalanche Bridge, which helped onboard more users into Avalanche and added new Subnets to make the users' and developers’ experience on utilizing and deploying blockchain applications more enjoyable.

.png)

.png)

.png)